|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding Mortgage Lenders in Lansing, MI: A Comprehensive GuideWhen it comes to financing your dream home in Lansing, MI, choosing the right mortgage lender is crucial. This guide will help you navigate the options and make an informed decision. Types of Mortgage LendersMortgage lenders come in various forms, each offering different products and services. Knowing their differences can help you select the right one. Banks and Credit UnionsTraditional banks and credit unions offer a wide range of mortgage products. They are a reliable choice for those who have an existing relationship with the institution. Mortgage BrokersMortgage brokers act as intermediaries between borrowers and lenders, often providing access to a wider range of loan products. Factors to Consider When Choosing a LenderSeveral factors can influence your choice of mortgage lender in Lansing, MI. Consider the following:

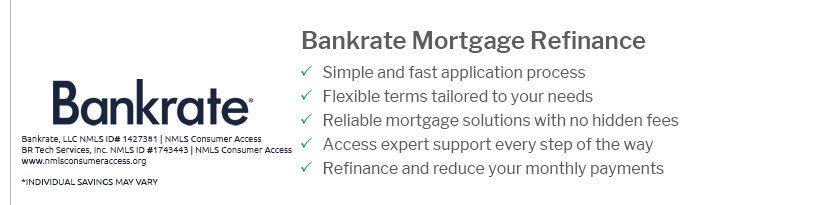

For more insights, you might want to explore best mortgage refinance companies reviews for a broader perspective. The Application ProcessApplying for a mortgage involves several steps. Here's a brief overview:

Refinancing Your MortgageIf you already own a home, refinancing your mortgage could be beneficial. Consider no fee refinance mortgage rates for potential savings. Frequently Asked QuestionsWhat is the difference between a fixed-rate and adjustable-rate mortgage?A fixed-rate mortgage has a constant interest rate throughout the loan term, while an adjustable-rate mortgage's rate can change periodically based on market conditions. How can I improve my chances of getting approved for a mortgage?To improve your chances, maintain a good credit score, reduce debt, and provide accurate financial documentation during the application process. Why is pre-approval important?Pre-approval helps you understand your borrowing capacity, making the home-buying process smoother and more efficient. In conclusion, selecting the right mortgage lender in Lansing, MI, involves considering various factors such as interest rates, fees, and customer service. Understanding the different types of lenders and the application process can aid in making a well-informed decision. https://www.zillow.com/lender-directory/mi/lansing/

View and compare Lansing mortgage brokers and Lansing mortgage lenders, read Lansing mortgage lender reviews, and write a mortgage lender review of your own. https://crosscountrymortgage.com/east-lansing-mi-2309/

Mortgage Lender, an experienced and local lender Mid-Michigan. We can ... https://www.flagstar.com/mortgage/steve-darnell-home-loan-mortgage-lender-lansing-michigan-770982.html

Steve Darnell - Mobile: (517) 881-1333 - Office: (517) 391-5870 - Email: [email protected] - Apply Now Contact ...

|

|---|